Flash Note

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement: Letter from the Fund Manager

Q1 2021

Carmignac Investissement1 gained +3.82% in the first quarter of 2021 vs +8.86% for the reference indicator2.

The Equity Market Today

While generating positive returns in the first quarter of 2021, Carmignac Investissement lagged its indicator after the very significant outperformance of 2020. Markets started out the year boosted by ramping vaccine roll-outs, hopes of reopening economies, highly accommodative Central bank policies and massive government fiscal support. This backdrop led to rising bond yields and a value-led equity market rally. Indeed, the former has been closely correlated with an outperformance of financials, while higher commodity prices have helped the energy sector record double digit gains – both sectors to which we were underexposed. On the other hand, rising interest rates penalized long duration growth assets that are core to our portfolio.

In the United States, the fast recovery of the cycle driven by efficient vaccination and impressive fiscal stimulus has led to a strong appreciation of the dollar, which weighed on Emerging markets and our Chinese positions. We do believe that this set of developments, which penalized our relative performance over the quarter, are likely to stabilize/reverse as we move through the year.

Our investment process revolves around identifying the most promising secular growth trends in order to invest in companies that can show strong growth regardless of economic conditions. This allows us to build strong convictions that can outperform over the long term, and to avoid secularly challenged businesses that fail to offer long term attractive and visible growth. Nevertheless, we will at times balance out our growth bias with derivatives positions on cyclical indices, as we did this quarter with long positions on European and US banking indices, which supported performance.

Portfolio Allocation

Over the first quarter we managed to generate alpha within our portfolio of secular growth names, in sectors like healthcare, consumer and communication services. However, the performance of our technology names lagged that of the reference indicator2, especially those positions in China. With the Chinese economy further ahead in the cyclical recovery than the rest of the world, we may be seeing a slowdown in the months to come that will work to the advantage of companies with predictable earnings growth that we hold in our portfolio. Finally, coming into 2021 we had significant positioning in companies poised to capitalize on the reopening of Europe, such as Worldline (digital payments), and tourism-oriented companies such as Ryanair (budget airline), Amadeus (ticketing), AENA (Spanish airports), Bookings.com (online travel), and Safran (short-haul jet engines).

These underperformed our expectations in the first quarter as the European reopening has been delayed by poor vaccination distribution. We believe that over the second and third quarters European vaccinations will ramp, and its economy reopen to significant pent-up consumer demand.

Among our top contributors of the quarter, we note Volkswagen, where our investment thesis relates to the company’s superior positioning for the transition from internal combustion engine vehicles to pure electric vehicles, but which also provided us with cyclical exposure within the portfolio. Alphabet and Facebook also recorded strong gains thanks to supportive trends in digital advertising. In healthcare, Chinese vaccine company Chongqing Zhifei and American healthcare service company Anthem both generated strong returns. Among our most significant detractors were Chinese datacenter company Chindata group and US software company Elastic – both with a high growth and valuation profile that was out of favor in the quarter but where we retain high conviction.

Our stock-picking approach aims to identify secular growth companies with strong and sustainable earnings prospects over time. We look for companies with large and growing addressable markets for their goods and services, and compelling penetration opportunities within those markets. We look for innovation and the ability to disrupt other market participants. Although the share prices of such companies are generally more expensive than the overall market, we believe they have the ability to rapidly grow into attractive valuations. On occasion it is possible to identify a company with vastly superior growth prospects to the overall market but that trades around the market multiple, as we found in the first quarter with Facebook. We moved to take advantage of this by making Facebook our largest position, as we have high conviction in its ability to not only continue to be a dominant force in digital advertising, but also to capitalize on monetization opportunities with Instagram, Whatsapp, and social commerce.

While Carmignac Investissement focuses on secular growth companies, its mandate does not exclude actively managing both the sizing of positions, their risk profile, and the overall cyclicality of the portfolio. As we do believe we are in a rising interest rate environment due to the reflationary backdrop, we have actively looked to limit our exposure to the high growth/high valuation parts of the secular growth opportunity set. Simultaneously to this cautiousness on valuations, we built exposure to the reopening of global economies, mainly through companies levered to European tourism as mentioned earlier, but also to global tourism and mobility like Carnival Cruise Lines and UBER. Over the first quarter we also increased our position in Capital One Financial, the leading US credit card issuer, which provides the portfolio with both “reopening” exposure and leverage to rising rates.

Outlook

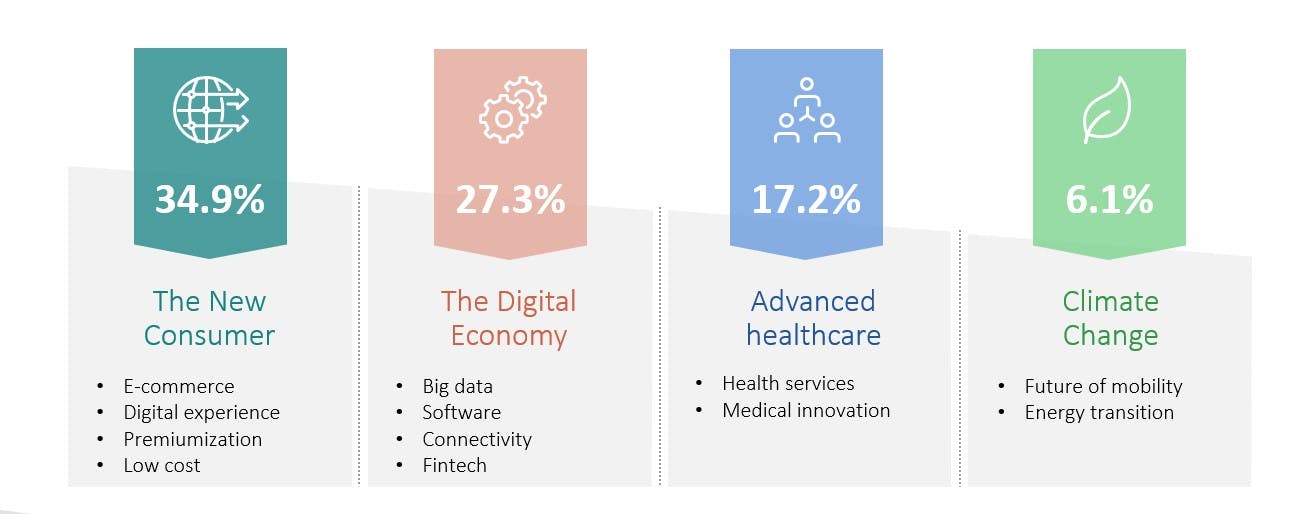

Overall, we maintain a liquid and solid portfolio of strong conviction investments, diversified in terms of geography, sectors and themes. Our core thematics revolve around:

These disruptive themes have proven to be particularly resistant to the global economic downturn brought on by COVID. Many of their adoption curves have sharply accelerated, driving up penetration rates and sustainable profits.

As global economies reopen it is our strong belief that these penetration gains will be maintained: consumers and businesses will continue to embrace the powerful trends of e-commerce, digital payments, cloud infrastructure, online advertising, and medical advancement.

Carmignac Investissement

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Looking for winners of today and tomorrow

- International equity fund with no restrictions in terms of region, sector or market capitalisation

- Performance drivers combining long-term trends and tactical opportunities

- A disciplined investment process based on fundamental bottom-up analysis to maximize alpha generation

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +21.41 % |

| Reference Indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +14.72 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +3.46 % | +11.61 % | +7.69 % |

| Reference Indicator | +9.06 % | +12.09 % | +11.12 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

1 Carmignac Investissement A EUR Acc (ISIN: FR0010148981).

Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. The portfolios of Carmignac funds may change without previous notice. Performances are net of fees (excluding possible entrance fees charged by the distributor). Annualized performance as of 31/03/2021.

2 Reference Indicator: MSCI ACWI (USD) (Reinvested net dividends).

Carmignac Investissement E EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.