Flash Note

2023 Outlook: seizing opportunities amidst a wall of worries

- Published

-

Length

4 minute(s) read

- A US recession later but deeper than expected

- Japanese equities should benefit from a more competitive Japanese economy

- In the credit markets, time is an investor's friend

2023 will be a year of global recession, but investment opportunities will arise from the continued desynchronization between the three largest economic blocs – the US, the Euro area and China. However, seizing these opportunities will require flexibility and selectivity.

Economic Perspectives

In the US, with almost two jobs vacancies for every unemployed American, the US labour market remains red hot. This supports wage growth for US workers, but in turn fuels inflation in the country. The US could see a sharper-than-expected decline in activity next year as the Federal Reserve (Fed) has made fighting inflation its main battle.

"We do not believe in the scenario that the US will experience a shallow and short recession early next year. We expect the US economy to enter a recession later this year but with a much sharper and longer decline in activity than anticipated by the consensus. Faced with inflation, the Fed will have to create the conditions for a real recession with an unemployment rate well above 5%, compared with 3.5% today, which is not currently envisaged by the consensus," says Raphaël Gallardo, chief economist at Carmignac.

In Europe, high energy costs are expected to affect corporate margins and household purchasing power, and thus trigger a recession over this quarter and next. The recession should be mild as high gas storages should prevent energy shortages. However, economic recovery from the second quarter onwards is expected to be lacklustre, with businesses reluctant to hire and invest due to continued uncertainty over energy supplies and financing costs.

"With a weak recovery and energy inflation continuing to feed into the cost structure, the European Central Bank (ECB) will face a quasi-stagflationary environment. Renewed fiscal activism could also intensify the pressure on the ECB and force a difficult debate on fiscal dominance", says Gallardo.

In China, the economy currently depends solely on the public sector, which is supporting growth thanks to spending on infrastructure projects. But the private sector is in the middle of a recession.

"With China's health system unable to withstand an "exit wave" from Zero COVID during the winter, the authorities were forced to support GDP growth by adopting a dual pivot, monetary and diplomatic. They agreed to ease liquidity conditions and began a détente with the US," says Raphaël Gallardo. “This bodes well for a gradual return to economic health.”

Our investment strategies for 2023

The typical recession playbook typically associated with the above-described environment calls for a portfolio leaning towards defensive bias. With on the fixed income front the favouring long term bonds issued by well rated issuers, on equities those companies and sectors providing for the greatest resilience and on foreign exchange markets currencies which tend to benefit from a safe haven status.

Even if the context may seem gloomy, this does not mean that there are no investment opportunities. After a year 2022 marked by the fast and most coordinated tightening of monetary policies of central banks around the world, 2023 will those same central bankers adopting more of a wait & see approach, to 1) assess the impact of such a rapid rise in interest rates and 2) cognisant of those risk to see the materialisation of a hard landing. Such a shift along with real bond yields coming back into positive territories, implies that fixed income markets have to a large extent reclaimed their defensive status. Likewise, the disinflationary trend over the first part of the year should turn in favour of visible growth equities.

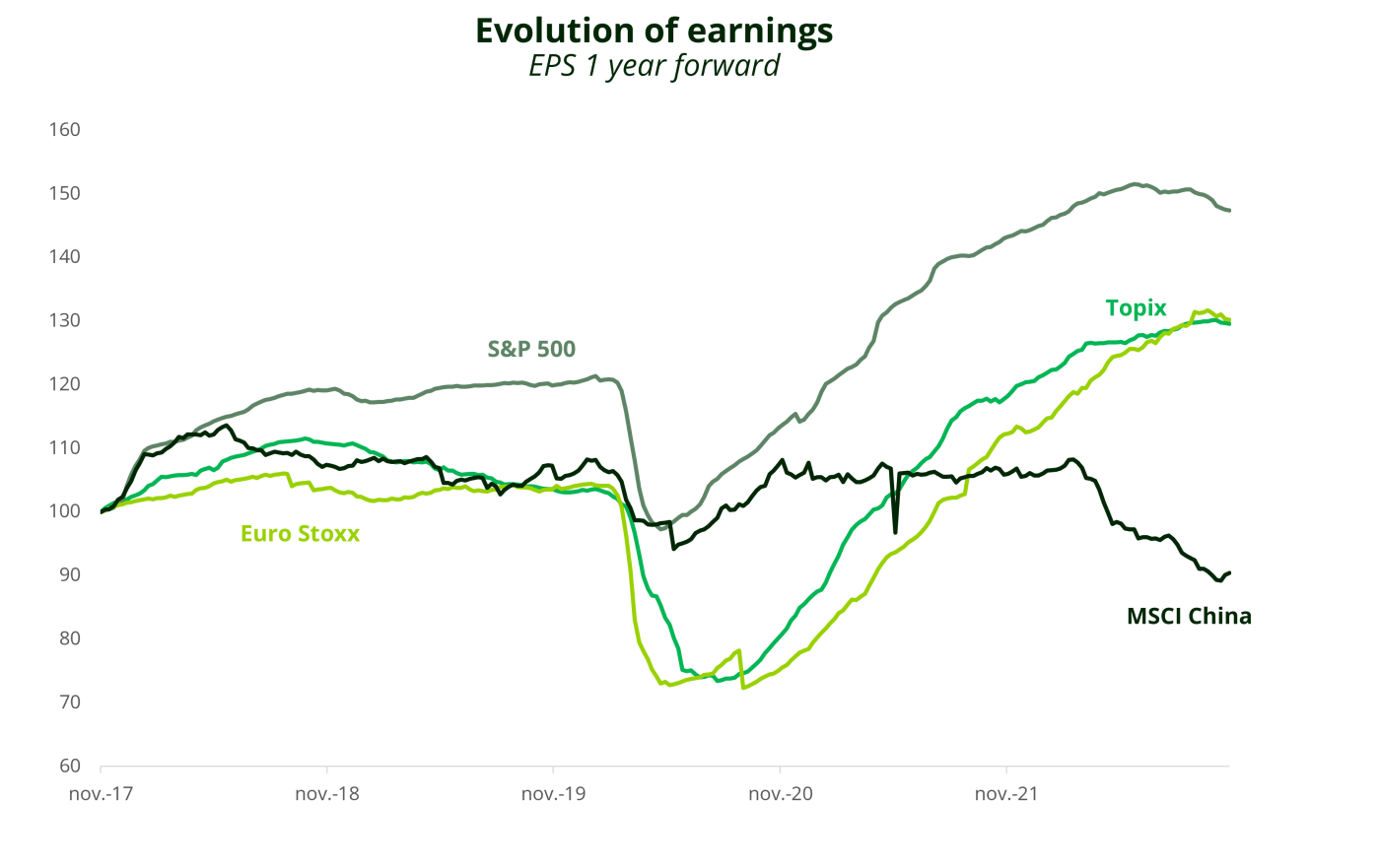

In equity markets, while the drop in valuations appear broadly consistent with a recessionary backdrop, there are wide disparities between regions - even more so on earnings. Earnings expectations remain high in the US and Europe, which is not the case in China, nor in Japan given the fall of the yen. And the eyes of global investors are focused on the western world inflation and growth dynamics. Looking towards the East should prove salutary and offer most welcomed diversification.

"Unlike the bond market, equity prices do not incorporate the scenario of a severe recession, so investors need to be cautious. Japanese equities could benefit from the renewed competitiveness of the Japanese economy, boosted by the fall of the yen against the dollar, but also from domestic demand. China will be one of the few areas where economic growth in 2023 will be better than in 2022, and all other things being equal, the economy is having an impact on corporate earnings", says Kevin Thozet, a member of the investment committee at Carmignac.

On the bond markets, corporate credit also offers interesting opportunities, because on the risk side, the expected rise in default rates is already largely incorporated in current prices. And on the reward side, embedded yields are at levels consistent with the long-term outlook for equities. On the sovereign bond side, weaker economic growth is generally associated with lower bond yields. However, given the inflationary environment, while the pace of tightening may slow or even stop, it is unlikely to reverse soon.

"In such an environment, longer maturities (5 to 10 years) are preferable. In the bond market, when yields rise, investors can afford to wait and see how things develop. The passage of time works in investors' favour. However, we have to be aware that the abandonment of financial repression means that some will be left by the wayside, even more so when the recession hits", says Kevin Thozet.

As we enter 2023, the “wall of worry” lingers. Investors’ focus remains on inflation and the risk of recession, which is not expected to affect the three major economies in the same way or at the same time. But, with desynchronisation comes the benefits of diversification. And with the volatility of financial markets comes the emergence of opportunities for which one will have to be selective and extremely agile in order to be able to seize them, which is the very definition of an active manager.