Flash Note

2021, a year of active stewardship illustrated

- Published

-

Length

4 minute(s) read

-

84engagements held

-

95%meetings voted

-

41%of meetings where Carmignac voted against management at least once

As part of our commitment to improve corporate governance practices, we actively engage with the companies we invest in. We assess their ESG behaviour, exercise our shareholder voting rights, help instil best practices, clarify our views and hold senior management accountable when issues arise.

-

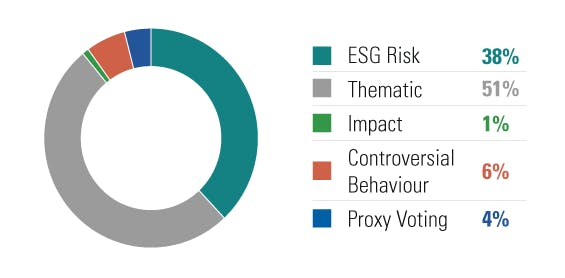

In line with our commitment to active ownership, Carmignac held 84 engagements with 74 investee companies in 2021: -

Split of engagement objectives - Carmignac 2021 engagements

-

As active investors, we use our shareholder rights to drive companies to improve their carbon footprint, human capital management and their governance. In 2021, Carmignac voted against the management of our investee companies at least once at 41% of meetings voted: -

Meetings voted for/ against Management

TotalEnergies

Sector: Oil&Gas

Region: Europe

The company’s equity is held within Carmignac Portfolio Green Gold, our thematic ESG

fund which invests in innovative companies that are actively addressing or contributing to

climate change mitigation across the whole renewable energy and industry value chains.

Carnival corporation & plc

Sector: Hotel, restaurants & leisure

Region: North America & UK (dual-listed)

A number of Carmignac’s fixed income funds are invested in the company.