Carmignac P. Emergents

May 2023

Portfolio News

Performance - F EUR ACC shareclass - Cumulative returns (%)

| May 2023 | 1 year | 3 years | 5 years | |

|---|---|---|---|---|

| Carmignac P. Emergents | -0,01% | +1,2% | +16,7% | +25,7% |

| Performance reference indicator | +1,8% | -8,0% | +15,6% | +5,9% |

As of 31/05/2023. Carmignac P. Emergents F EUR Acc (ISIN : LU0992626480). Reference indicator: MSCI EM NR USD) (Reinvested net dividends rebalanced quarterly). Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations. The fund presents a risk of capital loss.

Market Review

EM equities rebounded during the month, fueled by the excellent performance of Asian Tech & semiconductor companies.

Chinese market continued to fall amid weak macro data and ongoing geopolitical tensions. April data confirmed that the recovery is nascent and fragile. While service consumption remains strong on pent-up demand, the spillover from services to goods remains limited amid an incomplete job market recovery. Infrastructure investment is also decelerating amid funding pressure.

Latin American countries continued their rally, helped by decent economic data (GDP and CPI prints showing inflation is under control) and a relatively benign political environment.

Against a volatile backdrop marked by presidential elections, Turkish assets first sold off before ending the month higher led by the nomination of a new Finance Minister, signaling a shift towards more orthodox policies.

Performance Review

-

TOP 3 CONTRIBUTORS

Excellent rebound of our Asian Tech/ semiconductor names.

TAIWAN SEMICONDUCTOR (Tech) - Taiwan

SAMSUNG (Tech) - South Korea

TOKYO ELECTRON (Tech) - Japan

-

TOP 3 DETRACTORS

Weakness of Chinese consumer stocks.

MINISO (Cons. Disc.) - China

SEA (Com. services) - Singapore

ANTA SPORTS (Cons. Disc.) - China

Notable portfolio moves

New positions: -

Reinforcements: Taiwan Semiconductor (Taiwan), Kotak Mahindra (India), Beike (China)

Reductions: JD.com (China), Miniso (China)

Positions sold: Tokyo Electron (Japan)

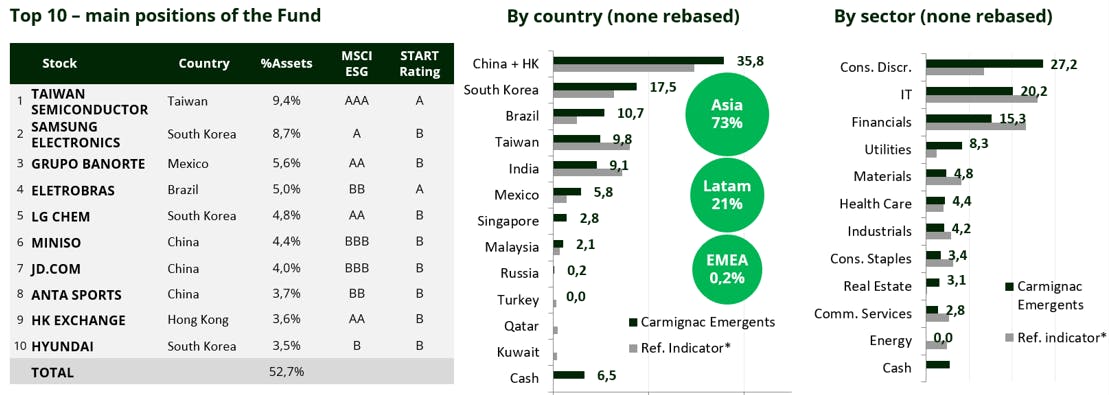

Number of holdings: 35 (target range 35/55)

Positioning as of 31/05/2023

Our portfolio is currently structured around 4 major socially responsible investment (SRI) themes that are central to our process:

Breakdown of the fund by SDG alignment

Strategy reminder

Carmignac Portfolio Emergents F EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Emergents F EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Emergents F EUR Acc | +6.45 % | +3.92 % | +1.73 % | +19.76 % | -18.22 % | +25.53 % | +44.91 % | -10.29 % | -14.35 % | +9.79 % | +5.61 % |

| Reference Indicator | +11.38 % | -5.23 % | +14.51 % | +20.59 % | -10.27 % | +20.61 % | +8.54 % | +4.86 % | -14.85 % | +6.11 % | +10.79 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Emergents F EUR Acc | -5.58 % | +7.58 % | +5.49 % |

| Reference Indicator | -1.81 % | +4.35 % | +5.34 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | We do not charge an entry fee. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,32% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,37% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |